Introduction

Imagine the creation of a new government program in which federal authorities send you a check at the end of the year to reward you for driving to work alone.

But there are a few catches. First, you only get the check if you work in a city—and you get a bigger check if you work downtown. Second, the size of your check depends on how much money you make. If you are a stockbroker or CEO, your check might be twice as big as that of the receptionist or salesperson working down the hall.

Such a program, it is safe to say, would be unlikely to get very far. Transportation experts would decry the idea of paying people to drive—especially commuters, who tend to travel during the busiest parts of the day. They would point out that the program would cost taxpayers money and would also add to the congestion experienced by every other driver on the road during each day’s commute.

And besides, why should those who work in the most congested places—and make the most money—get bigger rewards at the end of every year?

Surprisingly, such a program actually exists: the federal tax benefit for commuter parking.

The “commuter parking benefit” excludes the value of commuter parking provided by employers from the calculation of a worker’s taxable income. The “check” comes in the form of a worker’s income tax refund, which can be as much as $1,000 bigger as a result of not paying taxes on the value of the parking he or she receives at or near the workplace.

The check is bigger for people who make more money—and are in a higher federal income tax bracket—than it is for those who make less. And it is bigger for people who work in the downtown areas of major cities, where parking is most valuable.

Meanwhile, the costs of this program are borne by other taxpayers, as well as those whose commutes are made longer by the additional cars on the road. They are also borne by city and state governments that must repair the damage those cars inflict on the roads. And they are borne by the residents of those cities, who must endure more traffic, more noise, and more pollution.

The commuter parking benefit has been in existence, in one form or another, since the dawn of the Automobile Age. Eliminating it or limiting it, while wise, depends on congressional action and may be politically difficult.

But there is no reason that cities should be forced to endure the full magnitude of the problems the program imposes—especially when there are smart policy solutions that can be applied to limit the damage.

But there is no reason that cities should be forced to endure the full magnitude of the problems the program imposes—especially when there are smart policy solutions that can be applied to limit the damage.

In this report, we take stock of the damage caused by the commuter parking benefit in our cities—and of the failure of the corresponding commuter benefit for transit and vanpool services to fully mitigate the harm. We then propose a series of tools cities can use to minimize the negative impact of the commuter parking benefit and encourage workers to share rides, take transit, or walk or bike to work. The most powerful of these solutions generate new revenue that can be used to expand transportation options—not just for workers, but for everyone who lives and travels in cities.

We also take a look down the road at what a 21st-century system of federal commuter benefits could look like—one that is fully aligned with the nation’s transportation priorities, that incorporates new transportation tools and services when they help to achieve those priorities, and that eliminates arbitrary barriers that prevent too many working Americans from being able to access valuable benefits.

America’s transportation system is at a crossroads. Our dependence on cars leaves too many of us—as well as the cities and towns in which we live and work—poorer, sicker, and less happy. By aligning our tax code with efforts to expand transportation options, the federal commuter benefits program can be transformed from a wasteful and counterproductive tax expenditure to one that helps usher in a cleaner, more efficient, and more sustainable transportation system for the 21st century.

Press

Streetsblog: America Spends $7.3 Billion a Year Paying Affluent People to Drive to Work

Strong Towns: Who Pays for Parking? Unraveling the Hidden Subsidies that Clog Our Streets

Talking Headways (podcast): Episode 157: Subsidizing Congestion with Commuter Tax Benefits

Crain’s New York: How the federal government helps make your Manhattan commute hell

Bloomberg: We Are Subsidizing Rich Suburbanites to Clog Cities With Their Cars

Executive Summary

The United States currently spends approximately $7.3 billion per year to encourage people to drive to work through the federal income tax exclusion for employer-provided and employer-paid commuter parking. The “commuter parking benefit” puts more cars on the road in our most congested cities at the most congested times of day—exactly the opposite of what most cities want or need.

In an effort to counteract the effects of the commuter parking benefit, America also subsidizes people not to drive to work through the “commuter transit benefit”—a $1.3 billion program that enables workers to receive transit passes or vanpool services from their employers tax-free. The transit benefit attempts to support transportation policy goals, but it is overshadowed by the parking tax benefit’s much larger adverse impact.

America’s tax policy for subsidizing commuter travel is inefficient, inequitable, and lacks a coherent policy purpose. This report proposes a series of reforms to improve and modernize the tax treatment of commuter benefits—saving taxpayer funds, improving the quality of workers’ commutes, and making our cities better places to live and work.

America’s current tax treatment of commuter benefits adds cars to the roads and delivers the greatest benefits to those who need them least. According to Subsidizing Congestion, a 2014 report by the same authors of this report:

- The parking benefit adds approximately 820,000 automobile commuters to the roads, traveling more than 4.6 billion additional miles per year. The transit benefit removes only about a tenth as many vehicles from the roads—largely because it reaches far fewer people than the parking benefit.

- Only about a third of American workers receive any tax savings at all from the parking tax benefit—with the greatest benefits accruing to higher-income workers who drive to work in the nation’s large cities, where parking is most expensive.

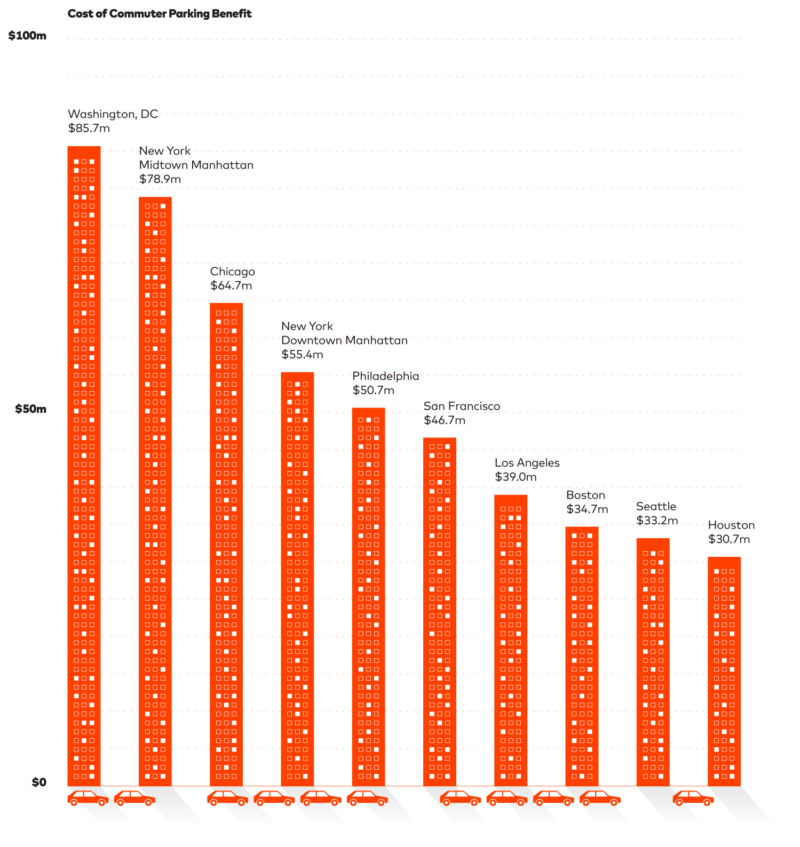

Commuter parking benefits amount to tens of millions of dollars in subsidies to people driving to work in major American downtowns.

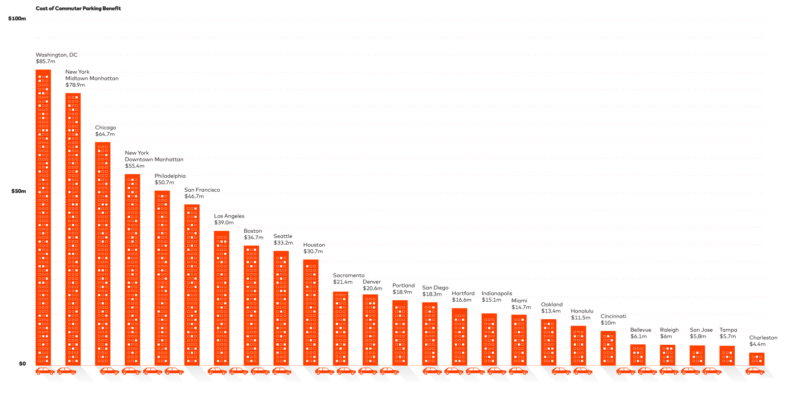

- The cost to taxpayers of the parking benefit for workers in just 25 major US central business districts (CBDs) likely exceeds $700 million per year. The districts in which the benefit imposes the greatest cost are those in which parking is most expensive and the percentage of people driving to work is highest.

- Of the 25 CBDs evaluated, the total cost of the commuter parking benefit is highest in downtown Washington, DC, at an estimated $86 million a year, followed by Midtown Manhattan, Chicago, Downtown Manhattan, and Philadelphia. (See Figure ES-1.)

- These tax expenditures for commuter parking distort daily transportation decision-making. Research shows that providing “free” car parking offsets the effects of incentives for transit use, carpooling, and bicycling.

- Eliminating the commuter parking benefit would remove approximately 66,000 cars from the road in these 25 central business districts, averting more than 370 million vehicle-miles traveled per year.

Cities can take three immediate steps to counteract the negative effects of the commuter parking benefit on congestion, public health, and urban quality of life:

- Expand access to transit benefits: Cities such as San Francisco, New York, and Washington, DC, now require many businesses to offer benefits for transit, bicycling, and/or carpooling to their employees. Early experience with these programs suggests that they can dramatically increase the number of workers able to take advantage of transit benefits and change commuter behavior. A study in the San Francisco Bay Area found that commuter benefit requirements have led 44,000 people to change their travel behaviors, avoiding 86 million vehicle-miles traveled.

- Tax parking: Numerous US cities tax parking provided in commercial facilities, while cities in Australia and Britain now assess annual taxes on parking spaces, whether they are provided at no cost or for a price. Taxing parking helps cities recoup some of the revenue lost because of the tax benefit for commuter parking and counteracts some of the incentive to drive into central cities that the benefit provides. Several cities have even reinvested their parking tax revenues into public transportation or local street improvements in support of an expanded range of transportation choices.

- Enlist the private sector in expanding transportation options. Many cities work with employers, major institutions, and residents to reduce single-occupancy vehicle trips and encourage alternatives to driving. These transportation demand management (TDM) programs educate employers and workers about their commuting options and organize activities and contests to encourage people to try new ways of getting to work. Local and state laws can promote these partnerships by requiring or incentivizing employers and developers to provide support for transportation options.

In the long run, the federal government should consider more fundamental reforms to the nation’s tax treatment of commuter benefits. These steps could include:

- Eliminating or limiting the commuter parking benefit: Nations such as Australia, Ireland, Austria, and Sweden have established systems for taxing the value of employer-provided parking that could serve as a model for the United States. Such a system might:

- Require employers who pay directly for their employees’ parking to report the value of that parking as taxable income.

- Require employers who provide parking at no cost to their employees to calculate the value of parking at nearby garages and lots and report that value as taxable income.

- The adoption of such a system would make no difference in the tax liability of the majority of Americans, who work in areas where parking is abundant and unpriced and, therefore, has little taxable value as defined by the IRS. It would, however, reduce the incentive to drive to work for those traveling every day to the centers of America’s largest and most congested cities.

- Expanding access to the transit benefit. In addition to requiring employers to offer transit benefits (as some major cities have begun to do), the federal government can expand access to transit benefits to independent contractors, the self-employed, workers in the “gig economy,” and others who currently are unable to benefit from them. Creating an income tax deduction for transit that is open to those who do not receive benefits through the workplace would allow for greater equity among different classes of employees and potentially support those who use transit for purposes other than commuting.

- Modernizing the transit benefit to include new and emerging modes of travel. A 21st-century system of commuter benefits should recognize the emergence of new “shared mobility” services and the growth of walking and biking by:

- Allowing expenditures for bikesharing to be eligible for tax-free commuter benefits.

- Allowing verified shared rides and “first mile/last mile” connections to transit via shared mobility services to be eligible for tax-free treatment. Current federal rules enable some trips via shared mobility services to be paid for through pre-tax earnings, but those rules push providers to use larger vehicles than necessary and do little to encourage the actual sharing of rides. Revising the eligibility rules for shared mobility providers can support the program’s intent of encouraging efficient travel that removes cars from the road.

- Investigating the potential of mileage-based benefits for employees who walk or bike to work, as exist in Belgium and the Netherlands. Even a reformed and expanded system of commuter transit benefits provides tax privileges to those with longer and more expensive commutes versus those who live closer to work or who use active modes of transportation. Creating a parallel benefit for those who walk or bike to work can further reduce single-passenger car travel and support the least energy-intense travel options.

- Collecting data and monitoring the performance of commuter benefits programs. Despite the roughly $8 billion-per-year cost of commuter parking and transit benefits, there has not been comprehensive study of their impact on the transportation system. Federal, state, and local governments should support research to better understand the effects of commuter benefits on travel behavior and adjust future benefits programs accordingly.

The Trouble with Commuter Benefits

These subsidies for employer-paid or employer-provided commuter parking subsidize traffic congestion by putting more cars on the road during peak hours in congested cities. The value of the tax subsidy increases with income and costs $7.3 billion annually in reduced tax revenue that must be made up through cuts in government programs or increased taxes.

The value of the tax subsidy increases with income and costs $7.3 billion annually in reduced tax revenue that must be made up through cuts in government programs or increased taxes.

In an effort to counteract the negative effects of the parking benefit and to improve equity, Congress created a comparable income tax exclusion for public transportation and vanpooling. But research has shown that providing commuters with both “free” parking and subsidized transit results in no change in behavior compared with offering neither benefit. And since many more Americans receive employer-provided or employer-paid parking than receive transit benefits from their employers, the net effect of US commuter tax benefits has likely been to put more cars on the road—undercutting key transportation policy goals such as reducing congestion and air pollution.

The parking and transit benefits may be offered as a supplement to an employee’s pay or in place of salary or wages. While an employee may claim both the parking and transit benefits in a given month, the parallel tax benefit for bicycle commuting cannot be combined with either of the other benefits or set aside from pretax income.

The commuter parking tax benefit exacerbates existing problems with traffic congestion, reduces state and federal tax revenue, and provides a greater benefit to higher earners.

The parking tax benefit disproportionately assists commuters who work in dense employment centers, such as downtowns, where parking is most valuable. Our 2014 report, Subsidizing Congestion, estimated that the effect of the subsidy was to put roughly 820,000 more cars on the road during peak commute times in congested cities, resulting in more than 4.6 billion additional miles driven each year by these subsidized commuters.

Because employer-provided and employer-paid parking is excluded from an employee’s income, the parking tax benefit accounts for an estimated $7.3 billion in lost federal and state income and payroll tax revenues every year.7 Both employees receiving the parking tax benefit as well as their employers avoid paying Social Security and Medicare taxes on the portion of income represented by parking provided or paid for by the employer. Most state tax systems follow federal definitions of income, meaning that states lose revenue as well. A reduction in government revenue inevitably results in either higher taxes, cuts to government programs, or a higher deficit.

While the vast majority of Americans drive to work, most do not gain from the commuter parking benefit. The reason is that parking is so abundant in many places—especially in suburban and rural areas—that it essentially has no value as defined by the Internal Revenue Service. As a result, only about one-third of commuters benefit from this policy. In fact, most Americans are net losers from the commuter subsidies, as they must endure higher taxes or reduced government services—as well as increased congestion—to subsidize parking for a minority of commuters.

Finally, the commuter parking benefit tends to disproportionately favor Americans in upper income tax brackets since its value is pegged to an individual’s taxable income. In addition, the benefit is most valuable to people who work in dense downtown centers, which are often centers of high-paying employment.

The transit tax benefit encourages Americans to use public transportation by making the cost of transit passes or vanpooling payable from pre-tax income. Academic research and the on-the-ground experience in cities (see page 38) suggests that the benefit can be an effective way to encourage workers to switch to transit—especially if they do not also receive subsidized parking.

The main impediment to the effectiveness of the transit benefit, however, is that few workers receive it. Only 7 percent of the American workforce has access to subsidized commuter transit benefits, 11 and only 2 percent of the US workforce uses them. Most employers—particularly smaller firms—do not offer employer-based transit benefits programs.

Like the parking tax benefit, the transit tax benefit disproportionately aids those with higher incomes who work for large employers in dense downtown districts. Workers in the top 10 percent by income are seven times more likely to have access to subsidized transit benefits than those in the bottom 10 percent of the income range.

While the transit tax benefit attempts to address important transportation policy goals, its effectiveness is overshadowed by the parking tax benefit’s much larger adverse impact. If the United States is going to use public policy effectively to meet critical transportation, public health, and environmental goals, it must reform its tax treatment of commuter benefits.

Federal law imposes a $255-per-month limit on the value of employer-provided parking that can be excluded from taxable income. There are, however, several American cities in which the cost of monthly parking regularly exceeds $255.15 According to federal law, any employer providing parking that exceeds that value must report the amount above the cap as taxable income. There is reason to suspect that enforcement of this provision is minimal and, therefore, that the cost of the commuter parking benefit may exceed most estimates.

Such reporting problems are most likely to arise with parking that is provided by employers to their workers at no cost or at a discount, rather than with parking benefits provided to employers in the form of pre-tax earnings for use at commercial garages.

Because most employers are not required to track the value of the parking they provide, enforcement of the monthly cap on parking benefits likely faces the same challenges as efforts to enforce tax laws for other forms of undocumented income. Underreported income is the largest source of underpaid taxes, particularly with “amounts subject to little or no information,” which are misreported 56 percent of the time.

The process of enforcing the monthly pre-tax cap is so cumbersome that enforcement may be hindered. The IRS outlines a five-step process for auditors: 1) identify whether the company provided the parking benefit; 2) acquire the list of employees who participated; 3) determine whether the tax-free benefit was applied correctly to worker pay; 4) learn how the employer calculated the fair market value (FMV) of the parking; and finally 5) modify the FMV calculation if the employer estimate was not accurate.17 Since the magnitude of underreported income because of commuter parking is likely to be small in relation to the nation’s $385 billion underreported income “tax gap,” enforcement of this provision is not likely to be a major focus for auditors.

There is little evidence regarding the degree to which employers comply in reporting as taxable income the value of parking provided in excess of the $255/month cap. An anecdote from the Massachusetts state government, however, suggests that compliance with the cap on commuter parking be may be limited.

In 2013, the Massachusetts Inspector General’s office audited employee parking at Massachusetts Department of Transportation (MassDOT) and Massachusetts Bay Transportation Authority (MBTA) facilities in Boston—a city in which the cost of parking frequently exceeds the IRS limit of $255 per month.20 The audit found that the agencies were failing to calculate the fair market value of parking provided to employees as required by federal tax laws. All told, MassDOT was found to be underreporting taxable income for its employees by approximately $246,000 in 2013. At the average marginal tax rate, this represented approximately $56,000 in lost federal income tax revenue and $12,000 in lost state tax revenue.21 Notably, the audit came not as a result of an IRS inquiry but rather “in response to a referral” from senior management at the agency itself.

The number of employers like MassDOT who underreport the value of parking provided to their employees is unknown. But experience with enforcing existing limits on employer-provided parking suggests that if the nation is to tax the value of commuter parking as income—and do it effectively—it will be critical to develop a clear, simple, transparent, and verifiable method for employers to calculate the value of the parking they provide. Such a method would go a long way toward increasing transparency and reducing the compliance and enforcement costs associated with treating the value of commuter parking as taxable income

The Commuter Parking Benefit Harms Cities

In America’s densest downtowns, tens of millions of dollars flow toward incentives for drive-alone commuters, even as improvements to accommodate safe and convenient public transportation, walking, and biking go unfunded. What are the costs of the commuter parking benefit in your city? And what are the impacts?

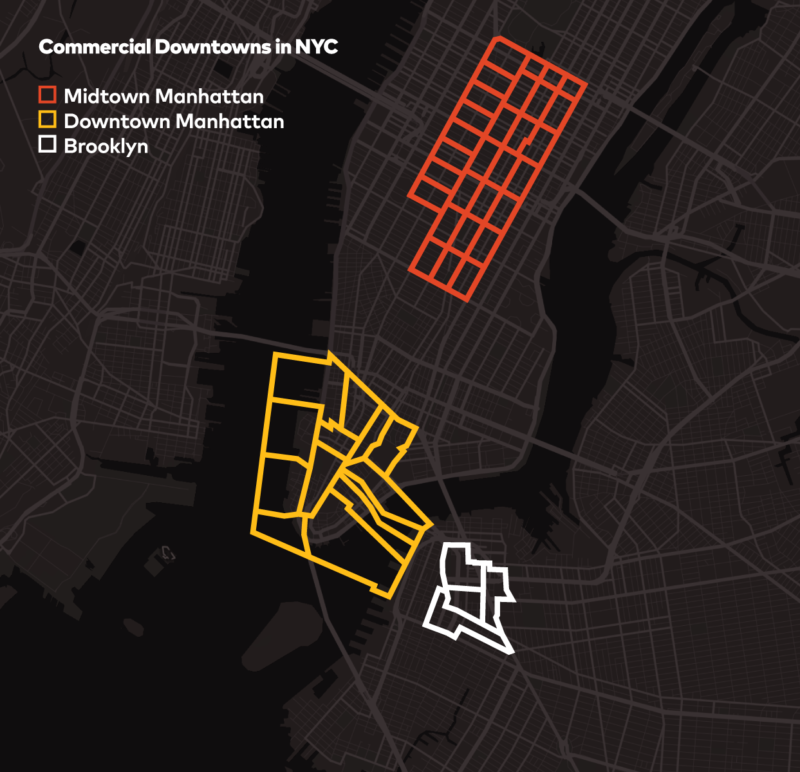

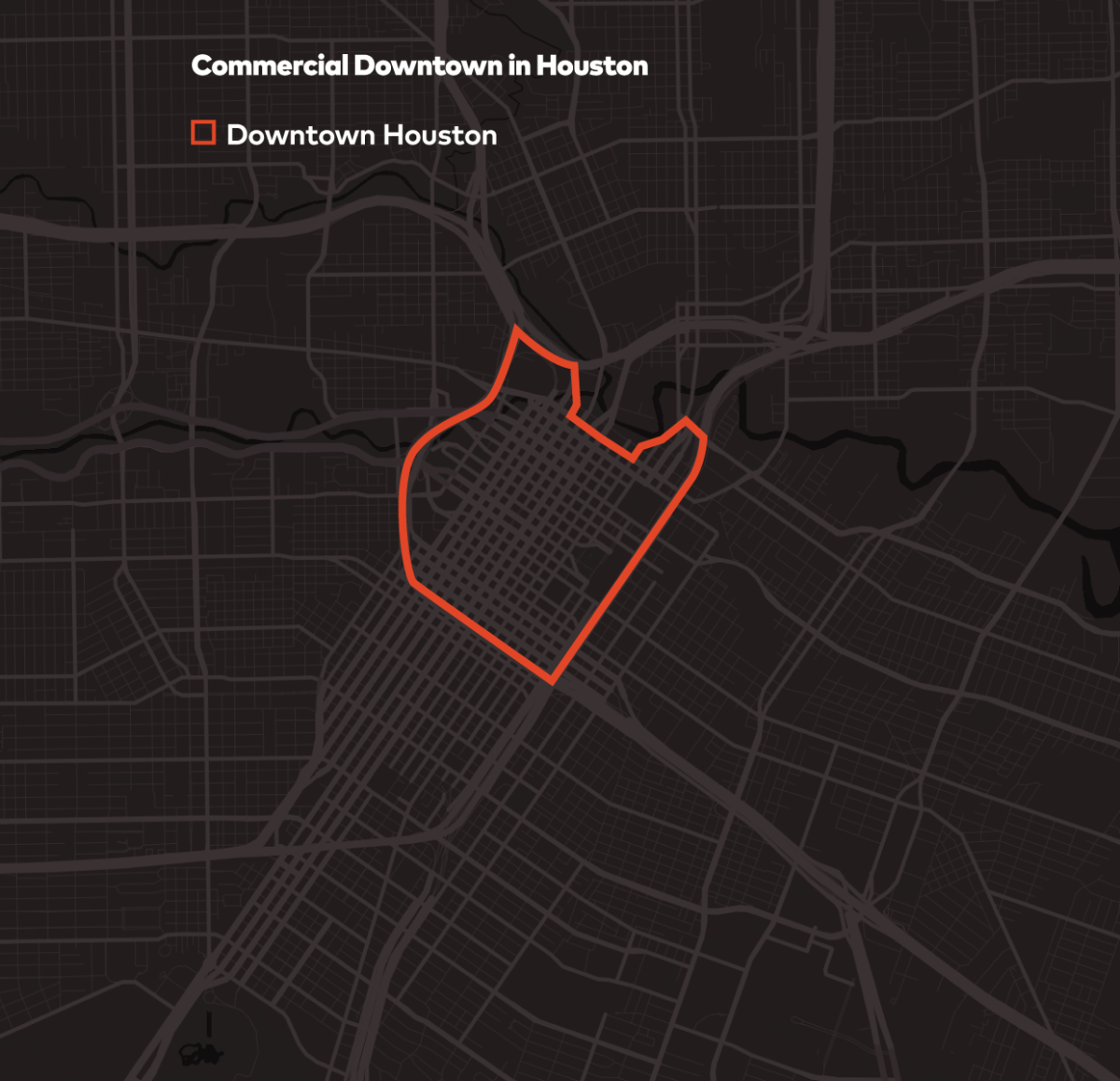

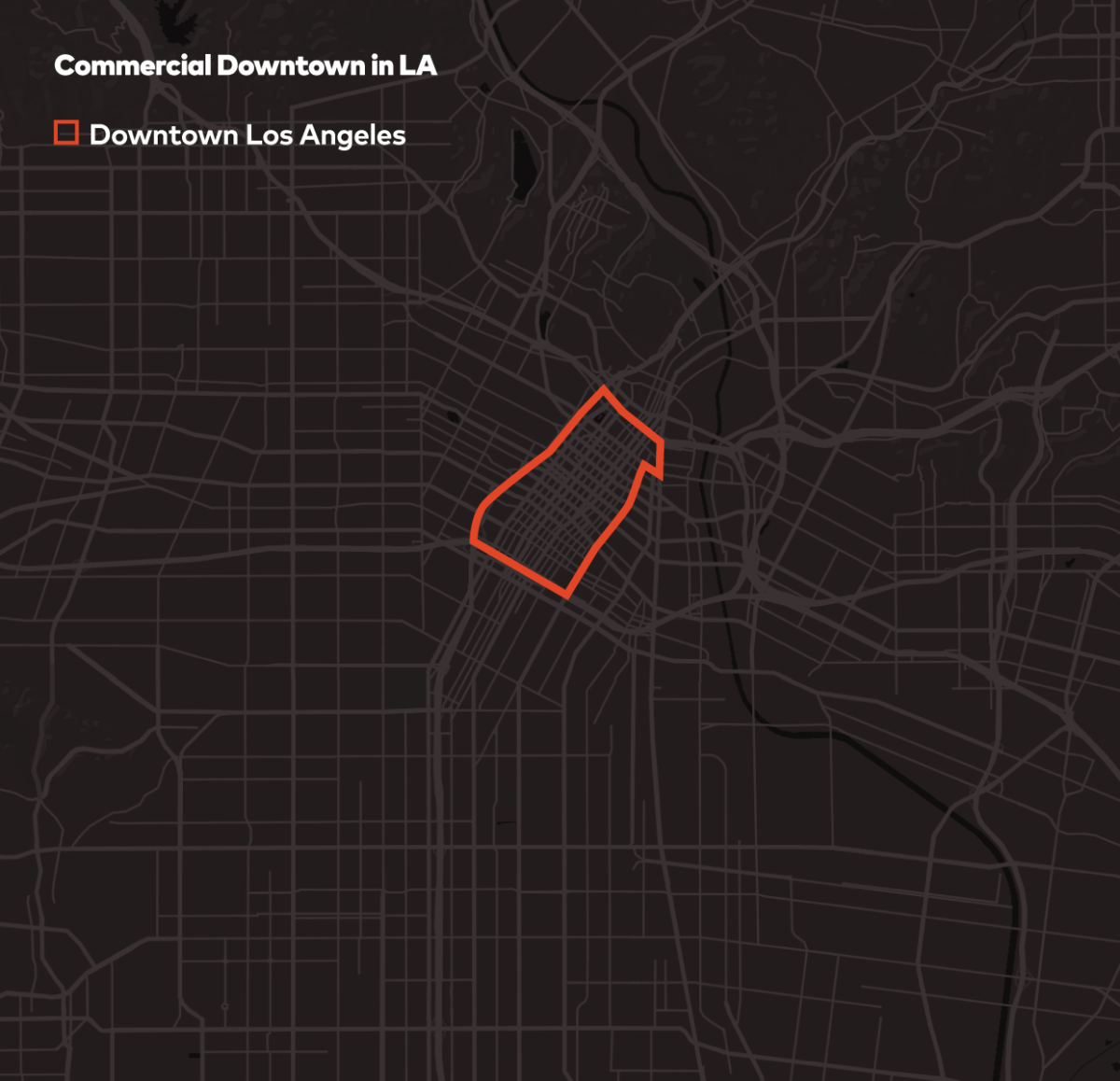

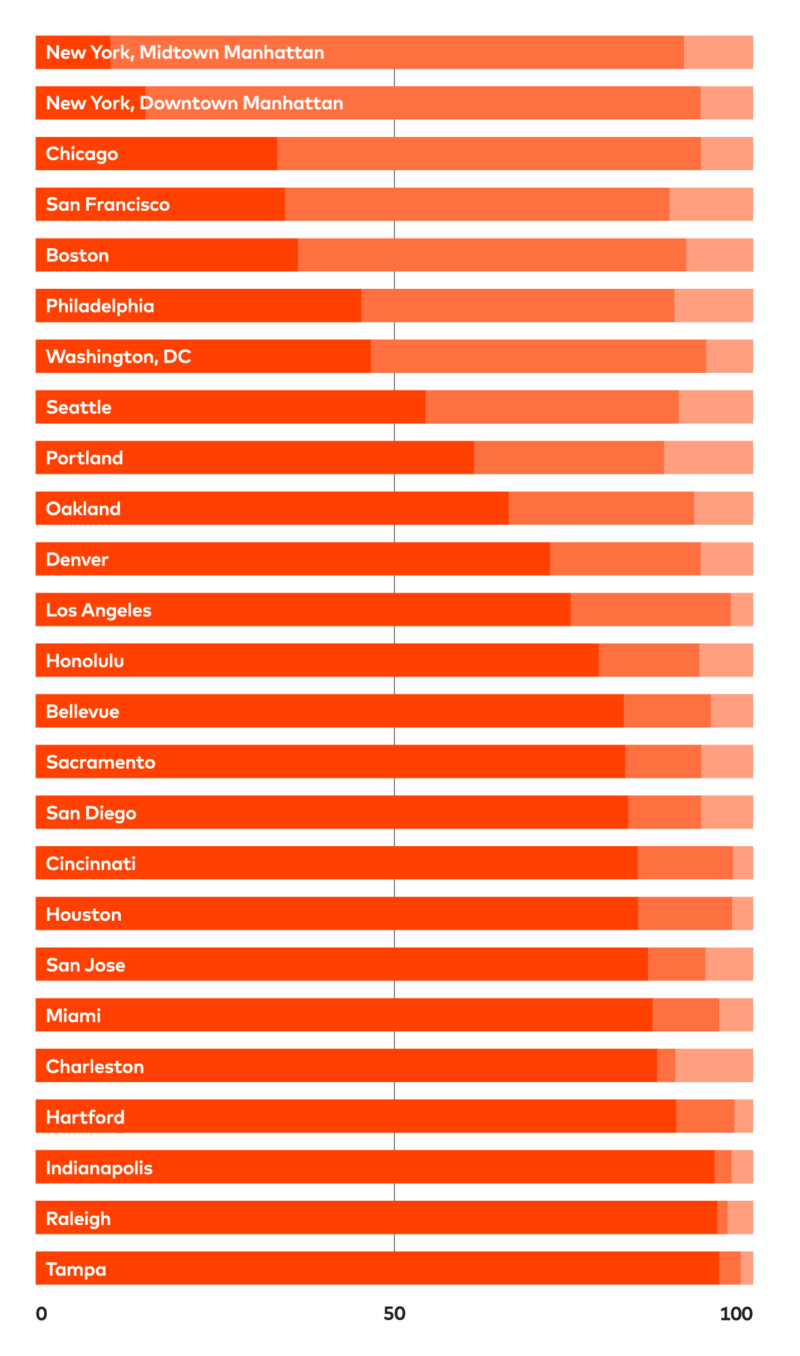

Excluding the value of employer-provided parking from taxable income represents a multimillion-dollar transfer of taxpayer funds to people who drive to work and to the companies that employ them. Based on data on parking costs in central business districts, as well as patterns of commuting to and from those districts, it is possible to estimate the cost to taxpayers of the commuter parking benefit by city. The estimates here are conservative and represent the estimated cost of the subsidy in 25 narrowly defined “commercial downtowns” in 24 cities for which data on the median cost of parking was available. They do not include the cost of parking benefits for workers in areas adjacent to commercial downtowns where parking may have value, nor do they include the cost of the benefits received by workers in secondary or tertiary business districts (such as health and education centers), where parking is often valuable. The estimates do, however, provide a window into the magnitude of the resources devoted to subsidizing car parking in our busiest downtowns.

The total cost to taxpayers of the commuter parking benefit in the 25 business districts studied was more than $700 million—about one-tenth of the estimated $7.3 billion national cost of the parking benefit. Approximately 4.3 million people were employed in these districts in the late 2000s, representing 3 percent of the US workforce. About 44 percent of workers in these business districts use cars as their main mode of commuting.

Of the 25 central business districts, Washington, DC, ranks first for total taxpayer cost of the parking benefit, at $85.7 million per year.

Of the 25 central business districts, Washington, DC, ranks first for total taxpayer cost of the parking benefit, at $85.7 million per year. This subsidy is flowing toward driving commuters even as the city’s transit system—which serves a greater number of downtown commuters—struggles to meet safety and repair obligations.

Commuters traveling to many of the central business districts studied here are also eligible for the commuter transit benefit. Indeed, some commuters—those who pay for parking at transit stations and also for transit passes—may receive both benefits. Across the 25 central business districts in this study, slightly more workers (2.1 million) list some form of transit as the main way they get to work than travel by car (1.9 million). The net cost of the parking subsidy provided to workers in these commercial downtowns, however, may still exceed the cost of the transit benefit, especially if a) more employers offer access to pre-tax parking than offer transit benefits, and/or b) the cost of parking exceeds that of the typical cost of transit. In addition, there are more than 200,000 people who walk to work in these central business districts and receive no commuter benefits, along with nearly 39,000 people who bike to work and can receive only $20 per month of pre-tax benefits for their commute-related expenditures.

At best, current commuter benefits work at cross-purposes in cities—expending vast taxpayer resources to encourage opposing behaviors on the part of commuters. At worst, they actively undermine cities’ attempts to reduce traffic congestion and to encourage workers to travel via transit, by bike, on foot, or in shared rides.

Peak-period driving is stressful in many American cities. In the 2014 report Subsidizing Congestion, the authors estimate that the commuter parking benefit adds roughly 820,000 cars to the nation’s roads each morning and evening commute. This added vehicle travel has several negative effects on cities:

- Congestion: Small changes in the number of vehicles on the road can have an outsized impact on congestion. In 2008, during the Great Recession, a 3 percent decline in vehicle travel nationally corresponded with a 30 percent decline in peak-hour traffic congestion. The tax subsidy to automobile commuters and their employers, therefore, likely imposes significant costs on other travelers in the form of additional delay on the roads.

- Loss of valuable urban space: Urban street networks are often designed to accommodate rush-hour traffic, even if they remain underutilized for the majority of the day. This perceived need limits cities’ abilities to repurpose street space for dedicated bus lanes, sidewalks, bike lanes, and other improvements that can enhance safety and encourage active travel. In addition, incentives for employers to provide or reimburse the costs of parking lead to the dedication of valuable urban space for parking as opposed to housing, public amenities, or commerce that generates tax revenues. A 2014 study found that land devoted to surface parking lots in a selection of US cities generated only 5 to 17 percent as much property tax revenue by area as land devoted to buildings.

- Poor health: Over the last decade, researchers have built a strong base of knowledge linking long automobile commutes to poor physical and mental health. Auto-dependent lifestyles have been linked to obesity, while people with long commutes have been shown to have less time to spend with friends and family or on activities that benefit their health, like exercise or sleep. Meanwhile, researchers have also found that those living near busy streets and highways—a category that includes many urban residents—are more likely to be exposed to air pollutants from vehicles and have a higher risk of developing or worsening respiratory problems.

Recognizing the health and livability improvements associated with reduced automobile traffic, many cities around the country and world have taken steps to reduce the number of people who drive into central cities at peak periods of the day. Federal tax law currently frustrates those efforts. Thankfully, there are many practical, proven steps that cities can take to counteract the ill effects of the commuter parking benefit.

Limiting the Damage from Commuter Parking Benefits: Three Things Cities Can Do Now

Cities around the country have adopted local policies that counteract the harmful incentives provided by the commuter parking tax subsidy—policies such as expanding access to commuter transit benefits, imposing local taxes on parking, and bolstering transportation demand management efforts that bring government and employers together to reduce reliance on single-passenger automobile commuting. Some cities have done all three of these things to create a coherent policy approach that limits congestion and pollution and supports the use of more sustainable modes of transportation.

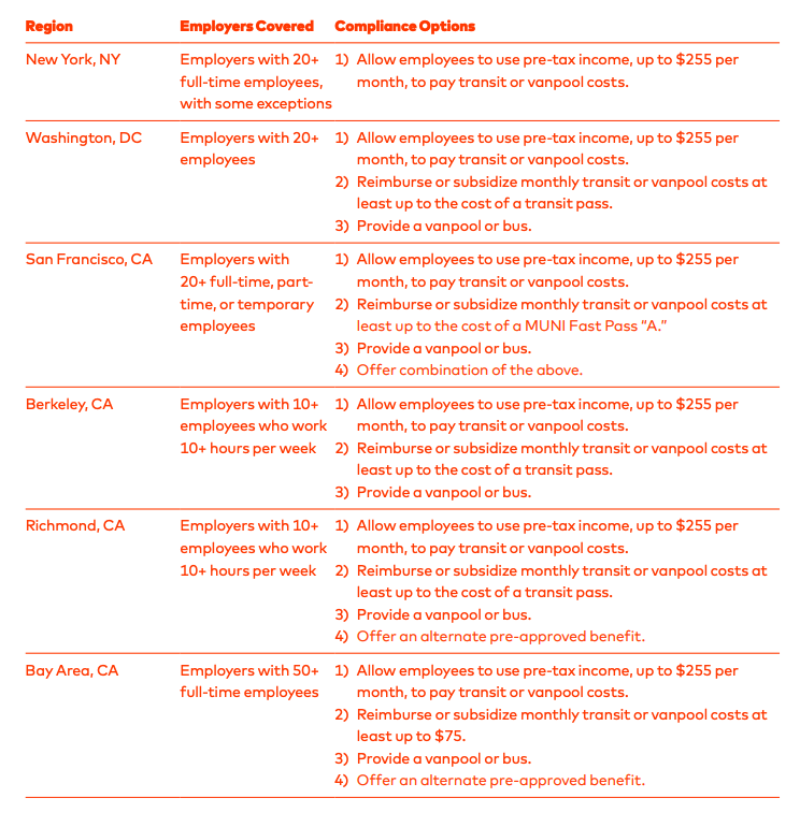

The primary weakness of the federal commuter transit benefit is that it reaches too few people. Cities around the United States are working to change that by adopting “commuter benefits ordinances” that require certain employers to offer transit benefits to their employees.

San Francisco was the first city in the country to do so, adopting a Commuter Benefits Ordinance in 2009 that requires businesses employing at least 20 people nationwide to offer transportation benefits to their San Francisco–based employees. Employers can choose to allow employees to pay for transit or vanpool expenses pre-tax (as is currently permitted under federal law), subsidize transit passes or vanpool expenses, provide a free vanpool or bus, or offer a combination of these benefits. The pre-tax option is capped at the monthly limit set by the IRS, while the employer subsidy must pay for all expenses up to the price of a MUNI Fast Pass “A,” which covers all travel on MUNI transit vehicles and Bay Area Rapid Transit (BART) trains within the city.

Newer commuter benefits programs in other cities follow similar formats. The Bay Area cities of Berkeley and Richmond require transit benefits to be offered by any company with at least ten employees who each work at least ten hours per week. As in San Francisco, both cities allow employers to choose among allowing employees to pay for transit out of pre-tax dollars, providing a subsidized transit pass, or providing a vanpool or bus. Richmond also offers additional flexibility, giving employers the option to devise an alternative benefit, subject to city approval.

In 2014, the Bay Area Air Quality Management District (BAAQMD) and the Metropolitan Transportation Commission (MTC) established the Bay Area Commuter Benefits Program, encompassing San Francisco, Berkeley, and Richmond, as well as several cities and counties that were not already covered by commuter benefits programs. This program is aimed at companies that have at least 50 full-time employees working within the BAAQMD. Employers’ options are the same as in the Richmond program, including the ability to design an alternative benefit. For companies with at least 50 employees, the Bay Area program overrides the San Francisco, Berkeley, and Richmond ordinances, meaning that large employers in those three locations register with the BAAQMD rather than their own cities.The first East Coast commuter benefit requirements began on January 1, 2016, in both New York City and Washington, DC. The New York City Affordable Transit Act applies to most employers with at least 20 full-time employees, requiring companies to either allow their employees to pay for transit expenses with pre-tax income or provide transit passes directly. The District of Columbia Employer Transit Benefit Ordinance applies to all employers with at least 20 employees and allows employers to choose among offering employees the opportunity to pay transit expenses with pre-tax money, directly paying for or reimbursing transit expenses, or providing a free vanpool or bus to employees. Additionally, there is a provision allowing the mayor to expand these transit benefits requirements to employers with fewer than 20 employees starting in 2017. Federal workers, a sizeable fraction of the DC workforce, already had access to transit benefits, and the ordinance expands access to these benefits to other workers in the city.

The two most established commuter benefit programs, in San Francisco and the broader Bay Area, have successfully expanded the number of employers offering transit benefits. In San Francisco, 37 percent of employers with transit benefit programs began offering them in response to the ordinance. At least 60 percent of companies registered with the BAAQMD and based in Alameda, Contra Costa, Napa, Santa Clara, Solano, and Sonoma counties reported that the Bay Area program led them to create transit benefit programs for the first time. Additionally, companies that already offered some commuter benefits expanded their programs after the law was passed. Overall, 55 percent of all Bay Area employers that have registered transit benefit programs have offered at least one new benefit because of the requirement.

Programs such as the San Francisco requirement have even had impact outside city limits. Of all companies that offered transit benefits to San Francisco employees in 2013, 61 percent also offered benefits to all their workers nationwide. Additionally, one-fifth of these national programs were started as a result of the San Francisco ordinance.

Effects on Employee Participation and Travel Behavior

Commuter benefits ordinances in the Bay Area have resulted in more employees accepting transit benefits and using transit.

In 2013, 23 percent of San Francisco workers with access to transit benefits chose to take advantage of them. The participation rate was only 15 percent, however, among employees at companies that had started offering these benefits because of the ordinance. This could be because workers at businesses newly offering benefits may be less frequent users of transit (perhaps because the workplace is not located near transit). It might also take time to build a market for transit benefits among those who may be inclined to use them. The San Francisco Department of the Environment is hoping to increase participation by “working with employers to effectively market the program and help employees understand the benefits available.”

Expanded access to transit benefits is only beneficial if employees choose to take advantage of them. In the first year of the Bay Area program, 2.1 percent of people who worked for qualifying employers reported increasing their transit use because of their new benefits. As a result, 44,000 people took 4.3 million fewer commutes by car, a reduction of 86 million vehicle-miles traveled.

Commuter benefits programs in New York and Washington, DC, have not yet been evaluated for their effects on transit usage, as they have been launched only recently. New York City reports that, through March 2017, the city had distributed more than 70,000 pieces of educational literature about the program. In addition, the city found that more than 4,000 employees were receiving transit benefits following interactions between their employers and the city’s Office of Labor Policy & Standards, suggesting that the total number of workers newly receiving benefits as a result of the ordinance is likely higher. Neither city, however, has a fully developed system or plan for monitoring and tracking the effectiveness of the ordinance in changing behavior, making it difficult to learn and apply lessons from their experiences to improve the programs in those cities or elsewhere.

Approaches to Enforcement

Cities with commuter benefits ordinances can encourage compliance by using “carrots” (e.g., technical and marketing assistance) to make it easier for businesses to offer benefits to their workers or by wielding regulatory “sticks” (e.g., warnings and fines). To date, cities have tended to rely mainly on a “carrot”-based approach, with early adopters of commuter benefits ordinances only now beginning to take enforcement action.

The New York City Department of Consumer Affairs (DCA) was not permitted under the terms of the city’s ordinance to issue fines for violations during the first six months the law was in effect, and the agency has continued to focus primarily on education since that period ended. Through an advertisement campaign targeted at both employers and employees, the DCA has directed people to read its website or call with any questions. As of March 2017, thirteen complaints had been filed with the city regarding enforcement of the ordinance, with six of those complaints resulting in businesses coming into compliance with the law.

In the Bay Area, local officials have placed a similar emphasis on outreach and education over enforcement. Extensive resources are available on the program website, and most counties have designated employer-services representatives who can collaborate with companies to develop workable implementation plans.

Because of limited resources, Berkeley has been unable to put much time into either outreach or enforcement. Its system is “complaint-driven,” meaning that workers need to complain that their companies do not offer the mandated benefits in order for the transportation department to take action—a situation that has not happened frequently.50 Because the commuter benefits program has not been widely advertised, the rarity of these complaints may be the result of low awareness of this program among employees rather than high compliance rates.

San Francisco, with the nation’s oldest local commuter benefits ordinance, has recently transitioned to an increased emphasis on enforcement. During the program’s first five years, city officials focused predominantly on outreach and education, collaborating with companies to find a vendor or combination of benefits that worked for them. The city did not start issuing warnings or fines until 2015, when 80 percent of applicable companies had already registered with the program.

Lessons from Commuter Benefits Ordinances

The early experiences of cities that have adopted commuter benefit ordinances suggest a few lessons:

- A commuter benefits ordinance can be an effective tool in expanding the number of people using transit and other alternatives to driving during rush hour.

- Effective ordinances are backed up with investments in marketing and technical assistance to employers in the context of robust transportation demand management programs.

- Commuter benefits ordinances can include options that go beyond those eligible for tax-free treatment under federal law. As a result, they can serve as a laboratory for policy innovation.

- To eliminate confusion and simplify enforcement, the ordinance should clearly state the specific types of benefits that must be offered by employers.

- Tracking employer compliance with the ordinance, as well as changes in benefits usage and commuting behavior among workers covered by the ordinance, is critical not only for enforcement but also to document whether it is an effective and worthwhile use of public and private resources. Additional data may provide further support for the effectiveness of commuter benefits ordinances in reducing single-occupant work commuting.

Cities should also advocate for their continued right to adopt local policies to expand commuting options for their residents and workers. In April 2017, for example, South Carolina adopted legislation that bans local governments from requiring employers to offer specific benefits to their employees, a law that applies to commuting benefits.

Tax Parking and Invest in Better Transportation

If the federal income tax exclusion for commuter parking provides an unwarranted tax subsidy for parking, local governments can assess local taxes on parking that recoup some of the cost of that subsidy for the public.

Cities generally assess parking taxes on commercial lots and garages (with some exceptions, see below), and assess the tax either at a flat rate or as a percentage of the parking charge. In large cities, parking taxes range from New York’s 18.4 percent to 20 percent in Chicago and Philadelphia to 25 percent in San Francisco and 37.5 percent in Pittsburgh.

These rates of taxation may seem high, but they are insufficient to cancel out the tax incentive for commuter parking for many workers. In 2015, the combined average marginal tax rate for federal income tax, the employee share of federal payroll tax, and state income tax was 35.1 percent.55 The commuter parking benefit exempts workers from paying this tax on the value of employer-provided parking. To fully counteract that subsidy, municipalities would need to tax employee parking at a rate of roughly 54 percent—well above even the highest parking taxes assessed in American cities.

Most parking taxes fail to counteract the effect of tax-free treatment of employer-provided parking in another way as well: they apply only to commercial parking facilities, not to the “free” parking offered by employers at their facilities. Several cities around the world have implemented taxes that apply to parking spaces regardless of whether they are provided for free or at a cost.

Parking taxes can be even more powerful when the revenue is used to expand or improve the transportation options available in a given area—providing alternatives to drive-alone commuting that can benefit both commuters and the broader community. Cities in the United States and worldwide have adopted this approach.

- San Francisco allocates four-fifths of its 25 percent tax on parking to the Municipal Transportation Fund, which supports operations of the city’s transit system.58 TransLink, the transportation agency serving metropolitan Vancouver, also assesses a tax on “parking rights” throughout the region, with revenues flowing toward transit and roadway improvements.

- Many cities have implemented “parking benefits districts” that use revenue from parking meters within neighborhood boundaries to pay for local street, sidewalk, and transit improvements. Boulder, Colorado, which has the nation’s oldest parking benefits district, has used revenues from on-street parking and municipal lots to fund bus passes for city employees and discounted bus passes for workers, as well as its bikeshare program.60 The parking fees collected by Boulder and other cities with parking benefits districts are not taxes, but they suggest one mechanism by which parking tax revenue could be reinvested locally.

- Nottingham, a midsized city in England, provides another example of what a “tax and reinvest” policy might look like. The city assesses an annual fee of about $465 per space for employers who own more than 11 parking spaces.61 Revenue from the tax has been dedicated to the addition of two tram lines, improvements in transit stations and local bus service, and transportation demand management partnerships with local employers.62 An evaluation of the program found an increase in public transportation usage and the number of employers locating in the city, without any increase in car traffic.

- The government of New South Wales, Australia, which includes Sydney, levies a tax on parking spaces within specified districts. The taxes affect both commercial and “free” parking. The parking tax raises approximately $100 million per year, which is primarily used to fund public transportation and commuter park-and-ride lots.64 Australia is also one of the nations that taxes employer-provided parking as a fringe benefit. (See page 60.)

Enlist the Private Sector in Expanding Transportation Options

Reducing rush-hour automobile commuting is a goal that local governments, residents, and businesses have rallied around in dozens of cities. Businesses often bear the expense of providing parking for their employees, and they also bear the cost of reduced productivity associated with congestion and long commutes. A growing body of evidence suggests that, compared to drive-alone commuting, workers who walk, bike, carpool, or ride transit to work arrive energized and refreshed, and experience lower rates of mental health issues.

Cities have used a combination of voluntary programs and mandatory regulations to get employers to provide incentives and support for workers who carpool, take transit, walk, bike, or telecommute, in what are often referred to as transportation demand management (TDM) efforts.

Cities have used a combination of voluntary programs and mandatory regulations to get employers to provide incentives and support for workers who carpool, take transit, walk, bike, or telecommute, in what are often referred to as transportation demand management (TDM) efforts. Typical practices of TDM programs include:

- Providing information.

- Promoting the business benefits of transportation demand management to employers.

- Developing comprehensive programs with mutually reinforcing services across a variety of travel modes.

- Providing incentives for transit and alternative modes.

- Creating disincentives for driving (through parking and pricing policies, etc.)

- Creating ordinances that reinforce TDM goals.

- Establishing caps on trips to or from a given area.

In rapidly growing cities, city governments are attempting to grow more efficiently by requiring new development to provide access to transportation options in addition to, or instead of, parking. One of the most comprehensive development-based policies is San Francisco’s “Shift” TDM law, enacted in 2017. Under the law, most multifamily buildings and commercial buildings over 10,000 square feet must include a number of incentives, amenities, and other strategies to reduce driving by tenants. These include:

- Reducing the amount of provided parking, charging tenants for parking, and unbundling parking (separating the cost to rent or buy a unit from the cost to rent or buy a parking space).

- Investing in pedestrian or bicycle infrastructure or on-site amenities.

- Providing free or discounted transit passes and carsharing or bikesharing memberships for tenants.

- Adopting land-use strategies, like the inclusion of affordable housing (low-income tenants have been shown to drive less) and on-site day-care facilities and grocery stores in neighborhoods that lack them (which reduces the need for tenants to make lengthy trips).

Similar requirements exist in communities large and small, including in Cambridge, Massachusetts; Bloomington, Minnesota; Washington, DC; and Arlington County, Virginia. These provisions build support for transit and active transportation into new development, allowing cities to grow without generating more traffic. (To learn more about these and other local development policies that support a balanced transportation system, read TransitCenter’s All Transportation is Local policy guide.)

Other jurisdictions have adopted or considered “parking cash-out”—a policy that requires businesses that offer free parking to their employees to give non-driving workers a cash payment of equivalent value. Parking cash-out can benefit employers by reducing the number of parking spaces they must rent to provide to their employees. It also benefits workers, the transportation system, and the environment by eliminating a powerful incentive for employees to drive to work alone. California adopted a parking cash-out law for certain employers in 1992, but many exemptions as well as a lack of enforcement have limited the implementation of this policy. A 1997 survey of California employers who had implemented parking cash-out found that drive-alone commuting to work declined by 17 percent. Efforts are now underway to improve enforcement of the California law, and the District of Columbia is considering a similar measure.

Other cities and states require employers or developers to reduce the number of vehicle trips to their facilities. Cambridge, Massachusetts, for example, has a Parking and Transportation Demand Management Ordinance that requires large, nonresidential facilities adding 20 or more parking spaces to meet specific mode-share targets, adopt TDM measures, and monitor and report their progress. Washington State’s Commute Trip Reduction Law requires employers with more than 100 workers in specified areas of the state to adopt plans designed to reduce the number of solo car commuters to their workplaces.

The presence of high-quality, well-resourced TDM programs can help businesses to expand the range and improve the quality of the commute options available to their employees. TDM programs have shown impressive results in shifting travel habits. Arlington County, Virginia, for example, operates a comprehensive TDM program that, as of 2011, was helping to shift more than 40,000 car trips per workday to higher-occupancy modes of travel—reducing vehicle-miles traveled, congestion, and pollution. The program has a goal of reducing the share of trips taken by single-occupancy vehicles by 0.5 percent each year for the next 20 years. Many colleges and universities have created similar programs aimed at students and staff.

Cities that are looking to counteract the effect of the parking tax subsidy can use TDM efforts in several ways:

First, they can use TDM programs to disseminate information about how best to comply with commuter benefits ordinances. The city of San Francisco, for example, provides employers with lists of third-party transit benefit administrators they can use to help them comply with the law.

Second, TDM programs can participate in decisions about the distribution of revenues from parking taxes or other sources of revenue. Washington State’s Commute Trip Reduction Board is empowered by law to allocate grants to help large businesses comply with the requirement to develop plans to reduce drive-alone commuting. The board consists of state, regional, and local government officials, business leaders, transit agency representatives, and citizens.

Third, TDM programs can use a wide range of innovative strategies to encourage workers to share rides or leave their cars at home. Often, these programs are carried out by Transportation Management Associations (TMAs), public-private organizations that bring businesses, government, and nonprofits together to develop solutions to employee transportation challenges. Approaches used by TMAs include:

- An annual “Bicycle Challenge” organized by MassCommute, a statewide association of TMAs in Massachusetts, in which workplaces compete to bike the most miles over the course of a single week. In 2016, nearly 2,500 riders logged more than 150,000 miles in the Challenge—a new record.

- A “transportation store” that dispenses transit fares, bike gear, and maps and works to improve biking and walking conditions within the district operated by Portland, Oregon’s “Go Lloyd” TMA.

- “Mobility Lab,” which serves as a national resource for research, best practices, and innovation in TDM, sponsored by Arlington County’s Commuter Services agency.

TDM efforts receive only a tiny fraction of the funding provided to highway expansion or maintenance. Federal funding, which supplies two-thirds of all government TDM funds in the US, amounted to $40 million in 2014, equivalent to about 0.1 percent of federal funding for highways. By allocating funds—including funds raised through parking taxes and other means—to TDM activities, cities can help to counteract the habits, cultural norms, and subsidies that push workers to commute to work alone by car and can often help them find healthier, cheaper, and more efficient ways to get to work.

Reforming Commuter Benefits: Three Things the Federal Government Can Do in the Long Run

States, regions, and cities can adopt policies that overcome the negative effects of the parking tax subsidy—for example, by requiring employers to offer commuter transit benefits, taxing parking, and/or supporting transportation demand management programs. But, in the long run, the nation should align the tax treatment of commuter transportation with its overall transportation policy goals.

Doing so will be politically difficult. Drive-alone commuters in the United States have enjoyed tax-free parking at or near the workplace since the dawn of the Automobile Age. The intense pushback against Internal Revenue Service efforts to tax commuter parking as a fringe benefit in the 1970s led to the creation of the current system of commuter benefits. Proposals to tax anything tend to generate political heat, while proposals that would increase the cost to the government of transit and vanpool benefits may run into resistance because of their impact on the federal budget.

Though systemic reform to commuter benefits may take time, it is important that advocates and decision makers begin now to consider strategies to eliminate the commuter parking benefit, reform transit benefits by including emerging modes of travel, and expand access to transit benefits.

The US Department of Transportation (US DOT) and similar bodies at the state and local level have adopted strategic goals for their management of transportation systems. In the case of US DOT, those goals have included:

- Improving safety

- Keeping the transportation system in a state of good repair

- Enhancing economic competitiveness

- Fostering quality of life in communities

- Ensuring environmental sustainability

There are many policy measures and expenditures of public funds that can support achieving these goals. Commuter benefits policies can play a particularly important role by targeting one of the most damaging ways in which we use motor vehicles: to commute to and from workplaces during rush hour.

Commuting represents only about 16 percent of all vehicle trips nationwide and only 28 percent of household vehicle-miles traveled. Each commute trip, however, has the potential to create outsized impacts on the economy, health, and safety:

- Even small changes in vehicular commuting greatly increase traffic congestion.

- Congestion adds to the health threats posed by vehicular air pollution—both for drivers themselves and for those living adjacent to roadways—with additional traffic adding significantly to the risk. A study by researchers at the Harvard School of Public Health estimated that congestion imposed $31 billion in public health damage and contributed to 4,000 premature deaths in major cities in 2000.

- Congestion constrains economic activity and job growth in cities.

- Congestion wastes fuel, contributing to global warming.

A sensible commuter benefits program would clearly signal to businesses and workers that options other than drive-alone commuting are preferred. Articulating a clear purpose for the program can help citizens and decision makers evaluate and reform the current system of commuter benefits to support the nation’s overall transportation goals.

Any program of commuter tax benefits should adhere to a few principles:

- First, the program should seek to be cost-effective—removing as many vehicles from the road as possible for a given investment of resources.

- Second, the program should seek to be as equitable as possible—reaching potential beneficiaries in an equal and nondiscriminatory way and distributing resources in a way that does not reinforce income inequality or other divisions.

- Finally, the program should be clear and easy to administer—creating certainty for businesses required to comply, individual workers claiming benefits, and the government officials charged with enforcement.

No program of commuter benefits is likely to be perfect by these measures, but by keeping them front and center in public policy debates, it is possible to maximize the effectiveness of any set of tax benefits.

Limit the Parking Benefit

The commuter parking benefit is out of step with the nation’s transportation policy goals. Eliminating this benefit, however, is easier said than done, and not just for political reasons.

For those employers who provide parking at no cost to their employees in lots that they own, or who contract for employee parking as part of their building lease, eliminating the parking benefit will require them to take the extra step of estimating and reporting the “fair market value” of the parking they provide to their employees—a calculation for which the IRS has provided little clear and consistent guidance.

Providing employers with clear and consistent guidance on how to value parking can reduce administrative burdens and assure fairness.

Nations around the world that tax the value of employer-provided parking as income have taken a number of different approaches:

- Standard valuation by zone: In Austria, employees who receive parking for free during working hours in an area with restricted parking (like downtowns), have the equivalent of $16 USD added to their wage base for tax assessment purposes each month.88 In Finland, tax authorities establish a set value for an employer-provided parking space in an indoor garage, with valuation varying depending on the city and neighborhood location and whether the garage is heated.89 In Ireland, workers in certain urban areas who use employer-provided parking pay an annual tax of just over $200, prorated for the portion of the year in which the parking is used.

- Specific method for calculating fair market value: Australian employers can calculate the taxable value of a parking fringe benefit in five ways, with the recommended method basing the value on the lowest daily fee charged by a nearby parking lot.91 (See below for more details.)

- General method for calculating fair market value: Canada stipulates that employers must report the fair market value of the provided parking, minus the amount the employee contributes (if any). The country offers little guidance as to how employers can estimate the fair market value but says it “is the price that could reasonably be charged for the use of that spot in an open market.”92 Employers must be able to justify the value reported. Tax authorities in Sweden suggest that fair market value be calculated based on “the value of a similar parking space in close proximity to the place of work” but note that comparisons must also account for the presence of amenities like wall outlets to plug in engine heaters, which are common in the nation’s cold climate.

- Exemptions: In some countries, rules exempt certain classes of employees or types of parking from taxation. In Canada, for instance, parking is exempt from taxation if an employee parks a car in an employer-provided space fewer than three days a week, if the place of work is near available “free” parking, if the employee needs the car for work, if the employer provides “scramble parking” in which there are fewer spaces than employees, or if the employer says it cannot determine the parking’s value. As a result, few employees actually end up paying the tax.

A particularly promising method is one used by Australia in the calculation of its fringe benefits tax, which taxes employers (not workers) based on the value of the parking they provide at the worksite. Under the law, employers pay a fringe benefit tax if an employee parks for more than four hours during general business hours at a lot under the control of the employer, near the place of employment, and there are lots within one kilometer of the employer’s lot that charge a daily rate of more than $8.26 in Australian dollars (approximately $6.17 in US dollars).

In addition to Australia’s fringe benefit tax for employer-controlled parking, the country levies a tax on workers if they park at a third-party lot that is paid for by the employer. A study of parking taxes in Melbourne found that more than 25 percent of commuters have parking fees paid by the employer.96 These employees pay a tax at their employee tax rate based on the cost of the parking received.

A US system built on these principles might do the following:

- Require the full market value of parking paid for via a cash transaction (employer-paid or employer-reimbursed) to be reported as income.

- For parking that is provided at no charge at a site owned or leased by an employer:

- Assess the value of parking based on the average daily cost of the three nearest parking lots or garages open to the public. For spaces that are reserved for the use of a single employee, the comparison should be with the monthly cost of a reserved parking space at the three closest garages or lots.

- Provide businesses the option of choosing to apply a flat annual valuation in lieu of calculating values specific to their locations, in order to reduce compliance burdens.

- Exempt employers from the need to include the value of parking in taxable income in areas where parking is typically provided for free or at minimal cost (e.g., no lot within a half-mile of the worksite charges more than $5 per work day for parking). This provision will eliminate any administrative burden for the vast majority of employers in the United States.

Such a system would eliminate much of the ambiguity that makes enforcement of the current limits on the parking benefit difficult, while also accounting for the dramatic differences in the value of parking across and within US cities and limiting compliance obligations to only those employers providing parking of market value to their workers. With information about commercial parking lot prices increasingly widespread in online databases like ParkMe, this system would be easy to implement compared to when the parking tax exclusion was first codified in 1984.

Should drivers change their travel habits in response to the change in taxable treatment of parking, the effects could be significant. Based on standard estimates of the price elasticity of transportation demand, limiting the commuter parking benefit could be expected to remove at least 66,000 automobile commuters from the road and reduce the vehicle-miles traveled in the 25 business districts covered in this report by 330 million.

Modernize the Transit Benefit

While the size of the transit benefit has changed over time, the structure of the benefit has not fundamentally changed in two decades. In the meantime, the number of urban transportation options has greatly expanded as cities have built protected biking infrastructure and bikeshare networks and mobile devices have enabled ridehailing and carsharing services. The transit benefit should be reimagined to reflect the more varied transportation options available in 21st century cities.

Expand Access to the Transit Benefit

The main problem with the current transit benefit is that it does not reach enough people to override the negative effects of the parking benefit.

Cities, regions, and states can expand access to the transit benefit through the adoption of commuter benefits ordinances and laws. But changes at the federal level could also help to expand access.

Reforming commuter benefits to expand access to those not in traditional employer/employee relationships can widen eligibility for benefits to the self-employed and independent contractors. This reform is particularly important given the decline in traditional work arrangements and the rise in contract labor and employment in the “gig economy.” Excluding workers in nontraditional work arrangements from commuter benefits programs shuts out millions of Americans who deserve to have access.

To expand access to the benefits and to ensure equity, the federal government could create a commuter income tax deduction that operates in parallel to the existing commuter tax benefit and is available to those who do not receive the benefit through the workplace. This deduction would enable taxpayers to deduct the value of transit passes or other eligible commuter expenses from their federal taxable income, up to the same dollar limits that apply to tax-free commuter benefits.

Creating such a deduction raises the concern that employers might be discouraged from offering the existing transit benefit. Employers who offer transit benefits, however, still save on payroll taxes and also benefit from employee satisfaction with the benefits.

States may also adopt credits or deductions for transit in their tax codes. The state of Massachusetts, for example, allows commuters purchasing Massachusetts Bay Transportation Authority transit passes to deduct the cost of the passes, up to $750 per year, from their taxable income for state income tax purposes.

Make Additional Modes of Travel Eligible for the Benefit

Current policies related to commuter benefits were developed prior to the explosion of technology-enabled shared mobility services in American cities that began in the early 2010s. As a result, commuter benefits policies are being used in ways that were not imagined at the time they were created—and are failing to take advantage of opportunities for reducing single-occupant automobile commutes that did not exist decades ago. For example:

Pooled ridesourcing vehicles and microtransit—Uber and Lyft have partnered with commuter benefits providers in New York City and elsewhere to allow commuters to pay for the UberPOOL and LyftLine shared ridesourcing services with tax-free commuter benefits. Federal rules limit the use of tax-free commuter benefits to “commuter highway vehicles,” which must seat at least six people (not including the driver). The rules also exempt private vanpool services from the “80/50 rule” that is applied to employer- or employee-run vanpool services, which requires that vehicles used in those services travel 80 percent of their miles in travel to and from work and have their seating capacity be more than 50 percent filled.

In the case of UberPOOL and LyftLine, the result is a perverse situation in which the companies are encouraged to put larger-than-necessary vehicles on the road to serve people using the transit benefit, with no guarantee that those rides are actually shared.

In addition to Uber and Lyft, several private “microtransit” services such as Via102 and Chariot103 accept tax-free commuter benefits for travel on their services (though these services typically use larger vehicles to serve their regular customers and are explicitly based on a shared-ride model, and so do not face quite the same perverse incentives as firms like Uber that supply a variety of vehicles in a given market and operate taxi-like service).

Employer shuttle buses—Employer-provided commuter shuttles have grown dramatically in some cities, most notably in the Bay Area, where “Google buses” or “tech shuttles” have become an important (and controversial) part of the transit system. As of 2014, employer shuttles in the Bay Area carried more than 9.6 million riders—a 45 percent increase since 2012. Combined, the shuttles serve more riders than some of the Bay Area’s suburban fixed-route transit systems that are accessible to the general public.

These employer-provided shuttles are treated as vanpools under federal law and can be provided to employees tax-free. However, the valuation rules traditionally applied to vanpools may be poorly suited to luxury employee shuttle buses. Travel in such vehicles is subject to the same $255/month limits as transit service. However, unlike transit passes, which have a clear and defined “fair market value,” employers can choose several methods under tax law to calculate the value of shuttle service, including methods that may establish artificially low values, reducing government revenues and providing a perverse incentive for the creation of new private services instead of the expansion of public transportation.

Shared mobility—Over the last several years, new types of shared mobility services, including modern bikesharing and one-way carsharing services like Car2Go have emerged in American cities. Unlike previous shared mobility modes, such as round-trip carsharing services, these new one-way modes are suitable for use as part of a daily commute, either by providing door-to-door transportation themselves or by serving as first- and last-mile connections to transit systems. Yet, under a 2013 IRS ruling, bikesharing is not eligible for tax-free commuter benefits, as bikesharing systems are not considered by the IRS to be “mass transit facilities.” Indeed, bikesharing is not even eligible for the bicycle commuting benefit, as that benefit only applies to expenses related to the purchase, maintenance, and storage of a bicycle.

A revised system of commuter benefits would refocus the program on the goal of reducing single-occupancy vehicle commutes and eliminate outdated program definitions and perverse incentives that hamper the program’s ability to respond to 21st-century demands.

An improved program might extend tax-free commuter benefits to the following services:

- Public transit passes or fare media.

- Employer- or employee-run vanpools and shuttle buses. The valuation rules for employer-provided shuttle buses should be revisited to ensure that they are not overly generous relative to the valuation methods used for public transportation and other services.

- Bikesharing.

- Verified shared rides and “first mile/last mile” connections to transit via shared mobility services. Current federal rules enable some trips via shared mobility services to be paid for through pre-tax earnings, but those rules push providers to use larger vehicles than necessary and do little to encourage the actual sharing of rides. Revising the eligibility rules for shared mobility providers can support the program’s intent of encouraging efficient travel that removes cars from the road. Verification could occur either on a trip-by-trip basis, or by providing data on the propensity for rides to be shared system-wide.

- Bicycle commuting expenses, which should be eligible for pre-tax treatment even when used in combination with other commuter benefits and be reformed to make the benefit easier for employees to access.

In addition to these benefits, policy makers may wish to consider the following options:

- Allowing employers to pay workers tax-free income corresponding to the number of miles they travel on foot or by bike in their commutes. Belgium and the Netherlands are among the countries that enable people who bike to work to claim these benefits (which are parallel to similar benefits offered to commuters in those countries who travel to work by car or via transit). Evidence from Belgium suggests that this system can increase the number of people biking to work. The Netherlands also allows employers to provide employees with a “company bike,” as well as associated gear and equipment, tax-free.

- Allowing the value of workplace parking to remain tax-free for employees who travel to work in a carpool. Carpooling is not specifically advantaged within the current system of tax benefits, and allowing employers to provide carpool parking tax-free would both encourage the practice and eliminate the administrative burden of distributing the value of parking and corresponding tax costs among various members of a carpool.

The cap on tax-free benefits should remain at approximately the current level of $255 per month.

America’s current system of commuter benefits—especially the parking benefit—has not been the target of comprehensive study. Given the large investment of public funds involved, that lack of study presents a missed opportunity to gain information and insights that might be used to make commuter benefits more effective. The public and decision makers deserve up-to-date and comprehensive answers to the following questions:

- How many Americans use commuter benefits, and how much do they cost federal and state governments?

- Which Americans receive the greatest benefits from the program?

- How do commuter benefits alter the behavior of businesses and individuals, affect transportation patterns in our cities, and shape the economics of parking and transit service?

A major program of reform for commuter benefits should be accompanied by a clear plan to collect data on how the benefits are being used, how new tax provisions related to the provision of commuter parking are being enforced, and what impact the changes are having on commuter travel behaviors. Given the rapid changes taking place in both the workforce and the transportation landscape, the federal government might also consider providing matching funds or other support to cities or states that implement new or novel pilot programs to experiment with various models of delivering commuter benefits.

One example comes from the Federal Transit Administration’s (FTA) Mobility on Demand program, which supports experiments that coordinate public transit service and emerging mobility providers. The FTA has awarded a $1 million grant to the city of Palo Alto, California, and a consortium of other local governments, transit agencies, business and civic groups, and private employers. The project will use enterprise software to automate employer-based commute programs at 11 companies with 27,000 workers, making it easier to administer transit benefits and other incentives. The companies will participate in a unique parking fee and rebate system: employees who drive alone to work will pay a small fee, and the fee revenue will go to employees who take transit or find other ways of getting to work without driving alone. Data from the project will help local transit agencies plan future routes.

Conclusion

A federal program that sends checks to people for driving to work—with the largest checks going to the wealthiest commuters in the densest cities—would be broadly recognized as counterproductive and costly. Yet that is exactly what the current federal tax treatment of workplace parking represents. Taken as a whole, America’s system of commuter benefits works at cross-purposes with several national transportation policy goals while imposing large costs on taxpayers and cities. By reforming commuter benefits to discourage drive-alone commuting, the nation can target transportation resources where they do the most good and make the tax system more equitable.

Cities do not have to wait for action in Washington, DC, to begin undoing the damage caused by the commuter parking benefit. Through smart, committed policy action, they can begin to lay the groundwork for reform while improving the quality of life in their communities.

Methodology

Cost of Commuter Parking Benefit by Central Business District

To estimate the cost to taxpayers of the commuter parking benefit for each of the 25 central business districts (or “commercial downtowns”) in this report, we used the following data sources and methods:

- The boundaries of the “commercial downtowns” were defined based on the census tracts used for the analysis in Downtown Rebirth: Documenting the Live-Work Dynamic in 21st Century American Cities, prepared by Paul R. Levy and Lauren M. Gilchrist of the Center City District for the International Downtown Association in 2013, and were supplied by the Philadelphia Center City District by request.

- The number of cars used for commuting into those commercial downtowns was based on data from the 2006–2010 five-year American Community Survey obtained from the American Association of State Highway and Transportation Officials (AASHTO) Census Transportation Planning Products website (data5.ctpp.transportation.org/ctpp/Browse/browsetables.aspx). Data are based on journeys to work by workplace geography.

- The number of vehicles used in commuting was estimated based on reported means of transportation to work and the following formula:

- Number of drive-alone commuters, plus

- Two-person carpool commuters divided by 2, plus

- Three-person carpool commuters divided by 3, plus

- Four-person carpool commuters divided by 4, plus

- Five- and six-person carpool commuters divided by 5.5, plus

- Carpool commuting groups of seven or more divided by 7.

- The number of vehicles used in commuting (the sum of the figures above) was discounted for the presence of part-time workers based on data on working hours from the 2010 American Community Survey. We assumed that everyone who worked more than 35 hours a week worked 40, those who worked 15–25 worked 20, and those who worked 1–14 worked 10, then multiplied the percentage in each category by number of hours and divided the total by 40. This led to the assumption that the number of commuters traveling to these districts daily was equal to 88% of the total workers reported to the census.

- For the purposes of this analysis, we assumed that all commuters reporting to the census that they traveled to work by car to a commercial downtown parked within the downtown area. There are three reasons why this assumption may under- or overestimate the number of commuters parking within commercial downtowns: 1) The census asks respondents to report the single travel mode used for the longest distance, not the mode used for the final leg of their journey. Some commuters may drive for the larger part of their commute, then park at a transit station or outlying area to transfer to another mode of travel for their final leg. As there is no way to determine the share of “car commuters” who might use another mode for the last leg of their commute, this method may overestimate the number of people parking in some commercial downtowns. 2) Commuters who do arrive at work by car may park in areas adjacent to commercial downtowns, again resulting in a potential overestimate of the number of vehicles parked in those areas. 3) Conversely, people working in areas adjoining commercial downtowns may park their cars in garages or lots within those downtown areas, resulting in an underestimate of the number of vehicles parked in those areas.

- The cost of parking in commercial downtowns was based on data from Colliers International’s 2012 survey of central business district parking prices. We assumed that the cost of parking in the central business districts as defined by Colliers would also apply to the commercial downtowns identified by Levy and Gilchrist, as cited above.

- To estimate the cost to taxpayers of the commuter parking benefit in each of those commercial downtowns, we made the following calculation:

We first estimated the monthly market value of parking used by commuters by multiplying the adjusted daily number of cars used in commuting to the commercial downtown by the median monthly parking cost from the Colliers analysis, and then multiplied that value by 12 to get the annual market value.